Consider this chart of four unrelated bond funds (click on image to zoom):

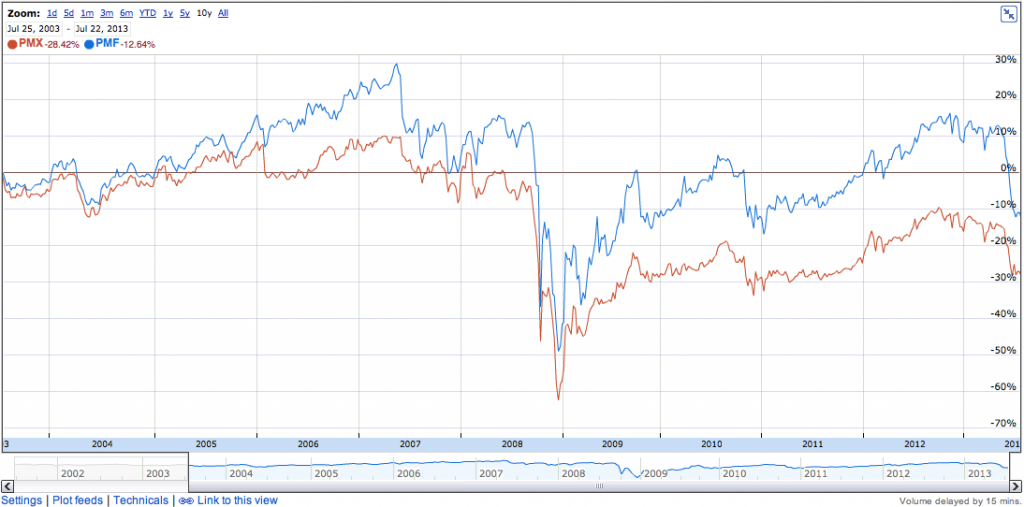

These are different types of bond funds; some use leverage aggressively, some are higher risk, some are actively-managed. They all share one thing in common: they’re down. But by different degrees. Pimco’s leveraged municipal funds (PMF and PMX) are the biggest losers and very much qualify as distressed debt. These are relatively low price volatility funds, when you look at a longer time horizon (click on image to zoom):

Ignoring the crash in 2008 and a couple of anomalous runs, both funds have been range bound in a 15% band throughout the past decade–although that range clearly reset in 2008. Plus, there are dividends–the current yield is 8%.

Both of the Pimco funds are extremely distressed right now for reasons that have been discussed in depth over the past couple of weeks: older bonds are lowering in value as yields go up, and borrowing costs are going up as yields go up. In theory, this could mean that the Pimco funds’ holdings have lost value, and the fund manager’s ability to make money in the future is going to be hobbled by the higher borrowing costs.

Investors in distressed equities can look at these funds as an opportunity–if the hypothesis above is wrong. If, on the other hand, higher yields will make the fund more valuable because its manager can lend out at higher rates, this might be a great buy opportunity to get some low-cost income-yielding assets. But at that point you’re buying into the fund manager’s ability to manage the fund more than you’re buying into the mechanism of the fund itself.

This partly explains why AGG and JNK have avoided the huge drops of the Pimco funds. Both of these funds are ETFs whose NAV and holdings are publicly displayed at all times and whose investments exist specifically to track an index. Thus their prices are much more closely tied to the NAV of the fund (AGG had a premium of 0.27% on July 19th; for PMX, the premium was over 10% on the same day).

The choice investors have, between the higher premium CEFs versus the lower premium ETFs is whether they want to bet on an undercapitalization of valuable assets based on fear in the bond market (in which case, bet on PMX and PMF), or if they want to bet simply on a downturn in bond rates in the near term (then AGG and JNK are the way to go).