The bear case for the S&P 500 hinges on two arguments: firstly, that a recession is looming because of the flattening yield curve that may likely invert before the end of the year and, secondly, the overvaluation of stocks based upon earnings.

As for a recession, it is undeniably that the 24 basis point spread between the 2-year and 10-year Treasury is microscopic by historical standards, but recessions are defined as two or more quarters of consistent negative GDP growth. But GDP growth accelerated in the second quarter of 2018, which is widely expected to be 3.6%, and growth for the full year is expected to come in at 2.8%, with 2.4% growth expected in 2019. From the simple perspective of GDP trends, it’s hard to see a recession anytime soon, regardless of the yield curve.

But what about earnings? That was the more pressing issue to investors in late 2017, and since the February selloff, it has largely receded to the back of investors’ minds. There’s a reason for that.

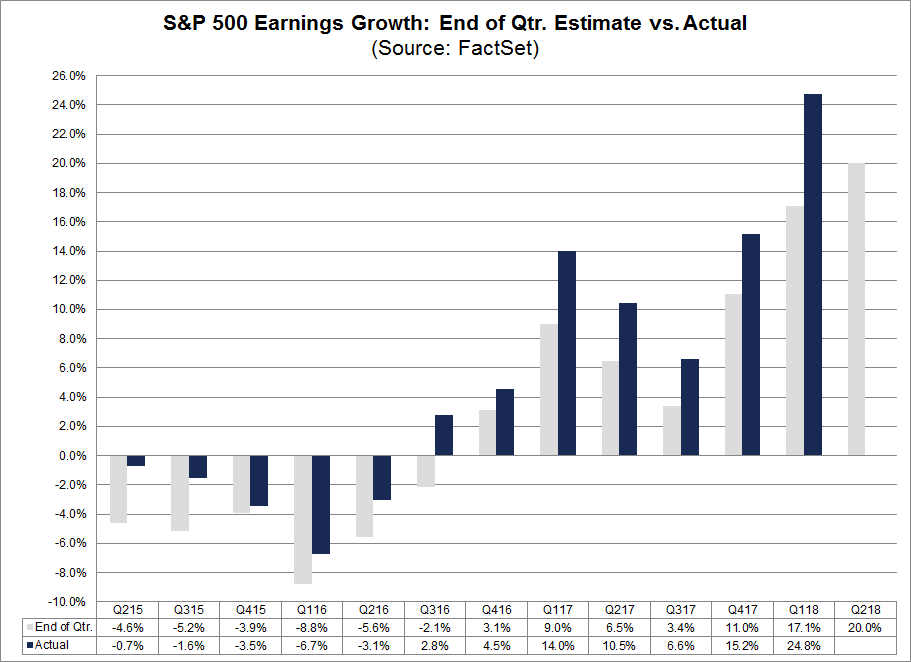

Earnings growth in the first quarter of 2018 was expected to be strong, but the actual results were almost off the charts. Look at this data from FactSet:

While expectations were high, at 17.1% growth, the reality was far beyond expectations—growth was 24.8%, the highest level since the Great Recession ended in 2009.

Earnings are also expected to rise at a colossal rate, with second quarter expectations for 20% earnings growth. Earnings season is just now starting, so it’s a bit early to see if those expectations are too rosy—but there is little data out there to suggest they are.

A combination of extremely strong earnings growth and relatively flat prices has caused valuation concerns to recede in the minds of most investors. We started 2018 with a P/E multiple for the S&P 500 of nearly 25—and it’s fallen to around 23 currently. The reason for that falling multiple is the sharp earnings growth and near flat price growth, improving the multiple for long-term investors.

There’s a pretty big lesson here, but it’s a counterintuitive one: the popular worry is often the wrong one. In early 2018, valuation concerns were a fever pitch, and that has been minimized, with a concern about the yield curve taking center stage.

Is the yield curve an actual issue to worry about? In short, we don’t know, but the popularity of the concern is in a way a reason to look for more evidence to back up that bearish thesis—just as such a hunt would have helped investors realize that their valuation concerns were misplaced, because absurdly strong earnings growth was in the cards.