The Federal Reserve has engaged in a bond-buying program that has proven controversial and effective. The idea of the program is that the Federal Reserve would buy $85 billion of bonds per month for as long as the Fed deemed necessary. The idea is that this would push bond yields down, making borrowing costs for businesses lower and thus encouraging them to invest more in the economy, which would inevitably result in an economic recovery for the country and the world.

In reality, the bond buying program has largely benefited stocks. The cause of this is simple: by buying the bonds, the Federal Reserve is expanding the total monetary base in the economy. This money must go somewhere, and a lot of it is going into stocks. This is causing stock prices to rise, which has helped two types of investors: macro traders and index investors. Index investors are doing well because the rising tide is lifting all boats, so just buying and holding SPY has yielded almost a 30% gain in 2013. Macro traders who understood the dynamic of the QE program and invested according have earned much more.

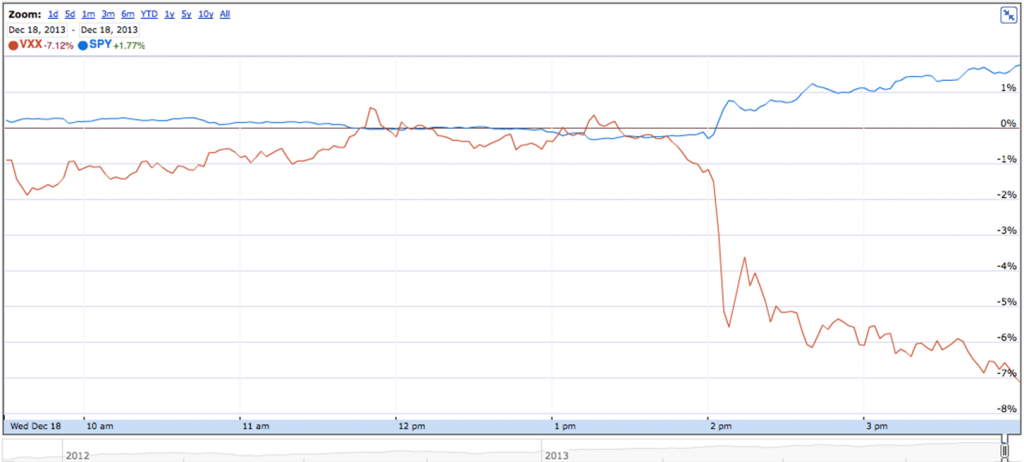

On Wednesday, the Fed announced that it would begin scaling back its bond purchasing program in January, lowering its spending by $5 billion per month. This tapering of the bond buying program is designed to ease bond markets into operating independent of the Fed. The taper was smaller than expected, causing stocks to rally.

To really understand what happened, we need to look beyond the S&P and think about how changes in volatility, which is a crude gauge of overall fear in the marketplace, responded to the taper news. There we see a very positive trend:

While stocks rose, volatility absolutely plummeted—a sign that exuberance is in the air.

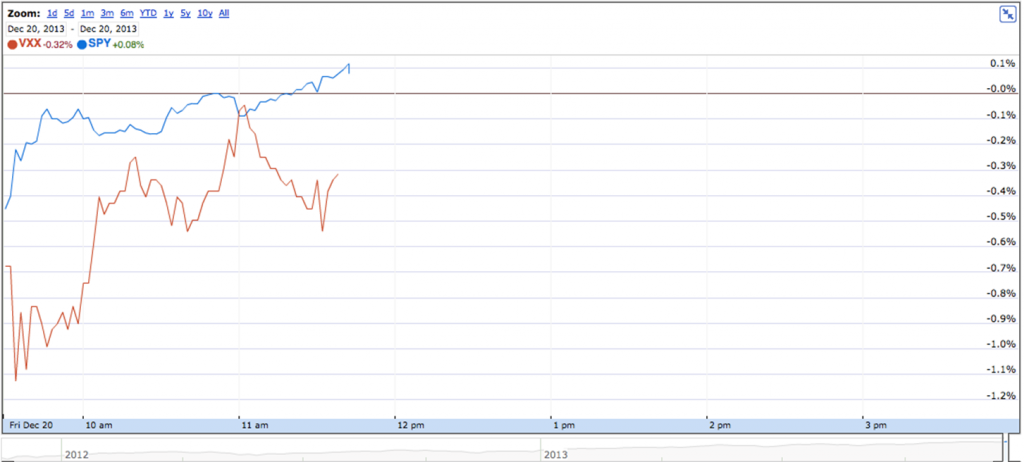

To understand what this means, let’s compare how volatility responded to another piece of very good news. On Friday, everyone was surprised to hear that the U.S. saw GDP growth of 4.1% annualized last quarter, much higher than expectations and well above the baseline for the U.S. over the past couple of generations. This number is arguably much more important than news of the taper; quantitative easing is a stop-gap measure, a kind of bandage used to help a healing wound. But the wound itself is low or negative GDP growth—and news that the U.S. economy is more productive should cause stocks to rise even more than the taper news and volatility to fall even further.

So what actually happened?

At the time of writing, the market is acting in a predictable and somewhat disconcerting way—equities are up, but only modestly. Volatility is down but, again, only modestly; in fact, volatility is down less than 0.5%, whereas volatility fell over 7% on the news of the Fed taper.

There are many possible conclusions to draw from this, but the most important is that the market’s expectations of future change in stock prices responds more to changes in the monetary base than in fundamental changes in the U.S. economy. In other words, the market believes that stock prices are not going to reflect company values in the future as much as they will reflect changes in the monetary base.

The market is not always right—some would say the market is very often very wrong. So investors, traders, and analysts need to consider how to proceed. Is now the time to go back to fundamental-based stock picking as the Federal Reserve quietly removes its influence from stock markets? Or is now the time to double-down on macro-economic based trading, as the market itself moves more and more in this direction?

Already, institutional investors are getting heavily shaken up. A good year for SPY is not a good year for money managers if they underperform the index—and that is of course easy to do when the index is up by nearly a third. This is causing a lot of soul searching and strategizing for 2014, which is already shaping up to be an interesting year.