Disney (DIS) bought Star Wars for $4 billion with the intention of releasing new movies and related merchandise under the Star Wars name as a revenue driver. Now that the new movie is out, headlines point to a record opening—earning $571 million globally, meaning the gross ROI of its purchase is already 14.3%.

Of course, the movie’s budget was $200 million, so net income from the venture is substantially less, but we’re only one weekend into the release, and there is merchandising income that is much harder to predict, although it is hard to believe that will not be significant, since products as diverse as toy light sabers and Star Wars themed mascara have shown up in recent weeks.

The most conservative analysis would conclude that the new Star Wars movie will bring DIS $1 billion in gross income, but let’s be charitable and super aggressive. Let’s say the new Star Wars movie will net the company $1.7 billion in net income net of expenses, COGS, marketing costs, and other expenses. That would mean the company has recouped 43% of its investment in the first movie.

What about the impact of the movie’s revenue to DIS’s revenues?

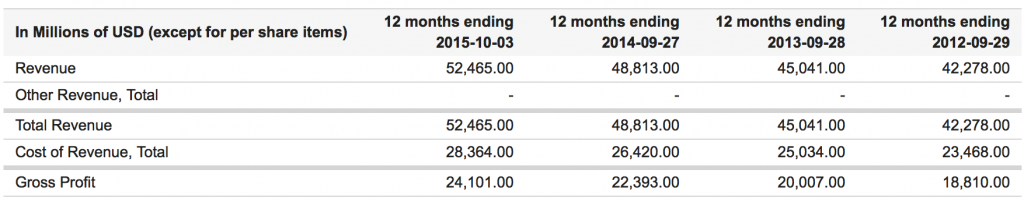

Taking a quick look at the company’s income statements over the last few years, we quickly learn just how significant Star Wars is for DIS shareholders:

For the last fiscal year, Disney’s gross revenues were $52.5 billion, so a $1.7 billion boost from Star Wars will help revenues grow by 3.23% next year, assuming our revenue estimate is right. Since DIS revenues are growing organically at about a 7.4% rate year-over-year, the incremental income from Star Wars would result in a 10% year-over-year revenue increase, assuming all else is equal.

That’s a great revenue accelerator, but has the market already priced in this catalyst, making it too late for us to profit from Disney’s new profitable franchise?

Friday was an awful day for Disney, which lost 4% of its value and closed at its lowest point since October. This was partly due to a downgrade that cited fears that Disney’s largest revenue driver—ESPN—is suffering from a secular trend of cord cutting, making viewership on the sports channel fall. This could mean the revenue contribution from Star Wars has not necessarily impacted the stock yet, being overshadowed by the ESPN story.

However, the stock is still up over 14% year-to-date, and its appreciation since it purchased Star Wars in late 2012 is the real story. Since it bought the franchise, the stock has doubled in price, handily beating the 42% return that the S&P 500 has delivered.

Now, analysts need to consider how much of that price growth is attributable to Star Wars income expectations. When they figure that out, and when they develop a thesis on Disney’s other revenue sources such as ESPN, they can then create their own price targets and decide if Disney, now 12.3% off its 52-week high, is a buy, despite being up so tremendously in the flat-to-down market of 2015.