Chinese online media company SINA Corp (SINA) surprised investors with EPS of 21 cents on Monday, a full 75% higher than expectations, which boosted the stock over 6% on Tuesday morning. Looking at the company’s YTD chart is a clear hockey stick pattern: up 65% since January 1st, the company is behaving like a typical fast-growing stock in a fast-growing sector.

And it should. Not only is SINA tied to mobile phone consumption, which is growing rapidly in China, but it is also a Chinese company, which means it is tied to that emerging market’s breakneck economic growth.

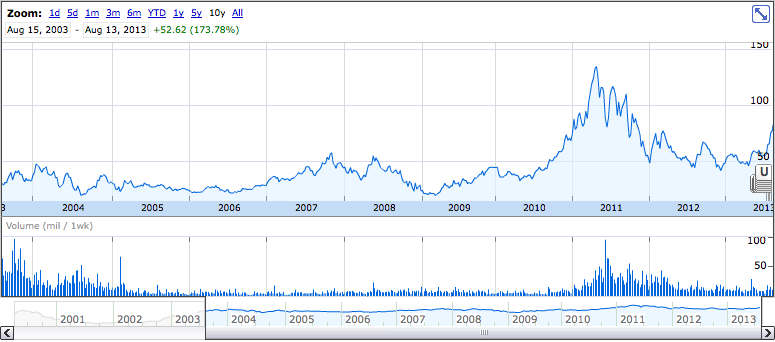

However, a bit of context and perspective should temper the recent exuberance. Over the last 10 years, the stock has only had a CAGR of 11.07%. On a risk-adjusted basis, this is horrible. The S&P 500 had a total return of 7.77% in the same period, so your alpha from investing just in SINA is meager, while taking on a big pile of risk.

Looking at the chart, you can easily see why. The company spiked in 2011 amidst hype that it was going to overtake competitors Tencent and Baidu (BIDU), and quickly lost market capitalization as revenue disappointed.

This extreme volatility, however, points to an opportunity: investors who are looking for huge short-term capital gains and who are not risk averse can take advantage of the two hot-button growth topics (China and mobile phones) to make tremendous returns.

But timing is everything. Investing in January 2011 and selling in April of that year would have given you a chance to double your money. If you’d done that instead in September, you’d lose over half your money.

Allocating capital efficiently is all about finding the value and where the future growth will be. That means timing your investments perfectly.

But how? With something like SINA, the answer is easy: know Chinese media better than anyone else in the market. If you know in what quarters the company will have better revenue and earnings and which quarters will disappoint, you can make huge short-term returns.

Believers in the efficient market hypothesis believe this is impossible–on average, investors will get this wrong as much as they get it right. However, hedge funds and many investment banks simply disagree in the EMH, and they can point to their funds’ performance as proof.

If you want to earn higher than average returns, you need to find a way to know how quarters will play out before they do, and invest accordingly. This is the secret to the oversized returns at the highest echelons of the professional investment world.