Passive income has gotten harder and harder to find since about 2010. This is both ironic and tragic, because in 2009 passive income was one of the easiest things on Earth to find, but back then most investors were terrified and avoiding the opportunities. That year was a great testament to Warren Buffett’s advice to “be greedy when others are fearful.”

That doesn’t help the investor of today looking for dividends, particularly since picking large-cap dividend stocks is a way to adjust aggressive portfolios for risk on the growth side of things. So our current situation leaves us with two problems: for retail investors, passive income is hard to find. For professional investors, adjusting portfolios for risk is hard to do.

Any dramatic decline in a dividend-yielding stock or group of stocks, then, becomes an opportunity to buy and secure a decent yield. For instance, a recent drop in JNJ has driven its yield near 3%, but that’s still nowhere near the 3.5% yields that could be had in 2010.

Other big dividend payers are also yielding at or below 3%: PG, MCD, KO, PEP, K, and other names in the CPG and similar verticals are offering paltry yields that are only slightly above 10-year Treasuries.

Then there are other verticals with higher but still reliable dividend yields. T is offering more than 5% and VZ is offering a bit above 4%. MO, RAI, and LO are offering about 5%. But telecom is brutally competitive, fast-changing, and unpredictable. Tobacco, fortunately, is on the decline in the first world and likely to see saturation and a decline in the developing world (although timing this is directional change is near impossible).

Yield has been an endangered species for years, leaving investors with the unenviable task of choosing between anemic options for risk-adjusted returns.

There has really only been one strategy to augment the limited options on the market: asset rotation. Instead of buy-and-hold for dividend growth, investors have had to sacrifice long-term investment to take advantage of cyclical capital flows. In other words, investors have looked at dividend-yielding sectors that are seeing higher or lower prices, and investing accordingly. This has meant alternating between dividends and growth, or going from energy to healthcare, or to some other sector.

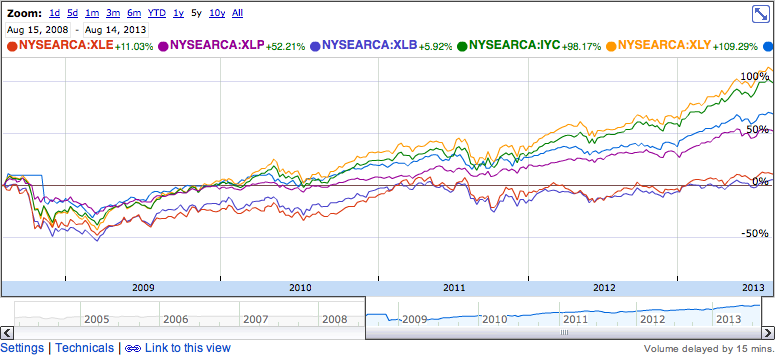

Again, the problem is where and when. Take a look at this chart of a few sector-oriented ETFs in the past five years:

You can see a number of divergence points (late 2011 and mid-2012 most prominently) where some funds go down while other funds go up, or they go up more slowly than others. These points of divergence are when capital begins to flow into or away from one sector. These moments are very difficult to find and profit from. But for investors who see these divergence points and take advantage of them, there is a profound alpha to be had. By identifying where money in the market is flowing before the trend gets noticed by a large number of people, investors can ride the tide before others get swept away.