Any investor under 25 is probably a bit confused at what’s happening this year. At least for equities, it’s not a year of stellar returns or extreme declines, while bonds have suffered a pretty bad year. This means that few retail investors have done exceedingly well, especially those who ascribe to the passive indexing approach to the market.

The irony in this is that it has provided an opportunity for unconventional market strategies and more active money management to outperform. While those outperformers have not yet announced their alpha to the market—the year isn’t over, after all—the financial press will likely take a look at those key winners in 2016.

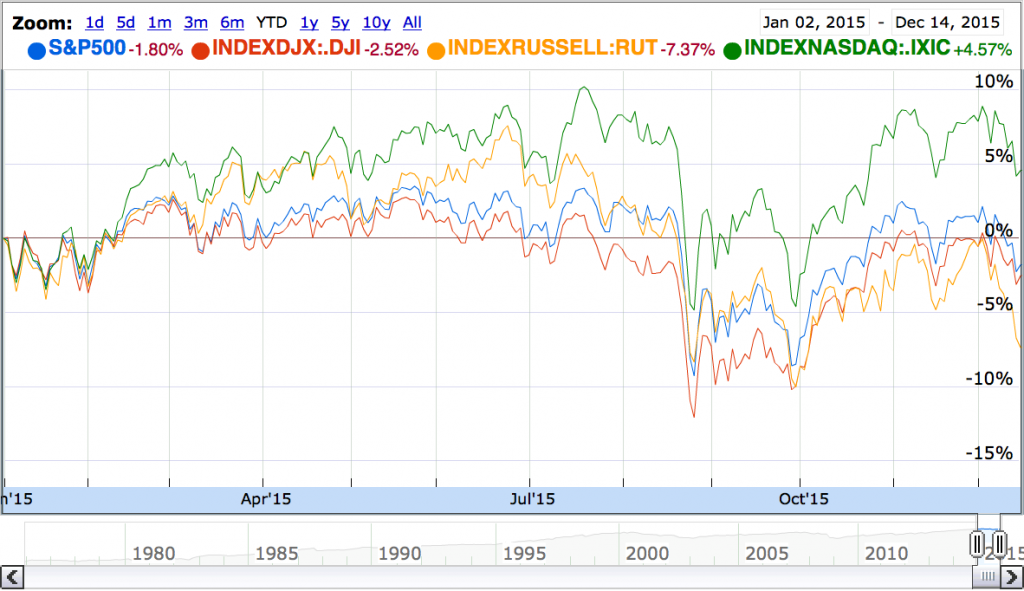

What we have seen in the year is a lot of sideways activity with one brief moment of panic at the end of summer:

Besides the August decline, when a bear market was a real possibility and a frequent headline title, the market has stayed mostly within a range of +/- 3% of its starting point for the year. This is especially true for the S&P 500 (SPY), which never saw anywhere near 5% gains in the year while seeing declines down to the double-digit mark in summer.

Large caps, as reflected by the Dow Jones Industrial Average (DIA), have seen even lower increases and an even steeper decline in summer. They have not recovered as much as SPY, and since conservative investors favor large caps over the total market, this could tell us that there is still a lot of fear among the most risk-averse investors.

Instead of fear, the Russell 2000 (IWM) is indicating plain panic. After breaching a 5% rise in June, the small cap group plunged to its lows alongside the others, and remains near its lowest point for the year. Since these stocks are usually held by the most risk-hungry investors, it tells us that they are also experiencing a great deal of fear right now, but this is a newfound emotion; earlier in the year there was great hope for smaller companies. That hope is gone.

Finally, in tech, we see the Nasdaq (QQQ) is the only group that is up year-to-date and the only index to not fall below a 5% loss in August. Here the exuberance that the small cap world felt remains present—presenting an interesting question. Is this because tech companies are less indebted in the corporate bond market, where we are seeing default fears growing? Is it because tech companies do not lose out on cheap oil, but actually gain from it, and is not dependent on oil and gas companies for their revenues as much as the rest of the market? Or is it just because the tech investors are more aggressive and less risk-averse than all other groups right now?

A quick comparison of these indices tells us something about the market mood right now, and also inspires us to ask more questions. This macro view is healthy and is something that fundamental and technical investors need to do every once in a while so that they can reality-check their own analysis and see if, and to what extent, parts of the market are as confident or wary as they are.